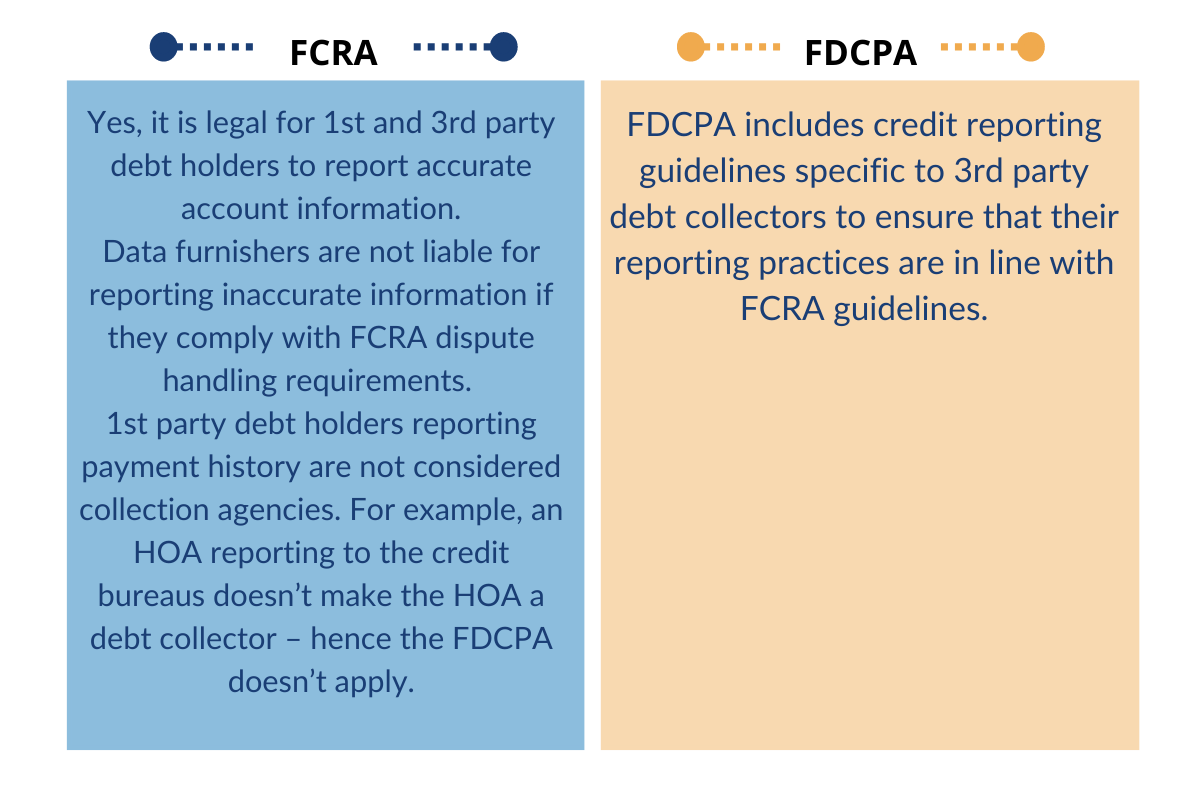

Yes, it is legal to report HOA Assessments to the credit bureaus. Similar to credit card or mortgage payment reporting, The Fair Credit Reporting Act allows for the reporting of community association payments and delinquencies to a credit bureau, on behalf of an HOA or condo board.

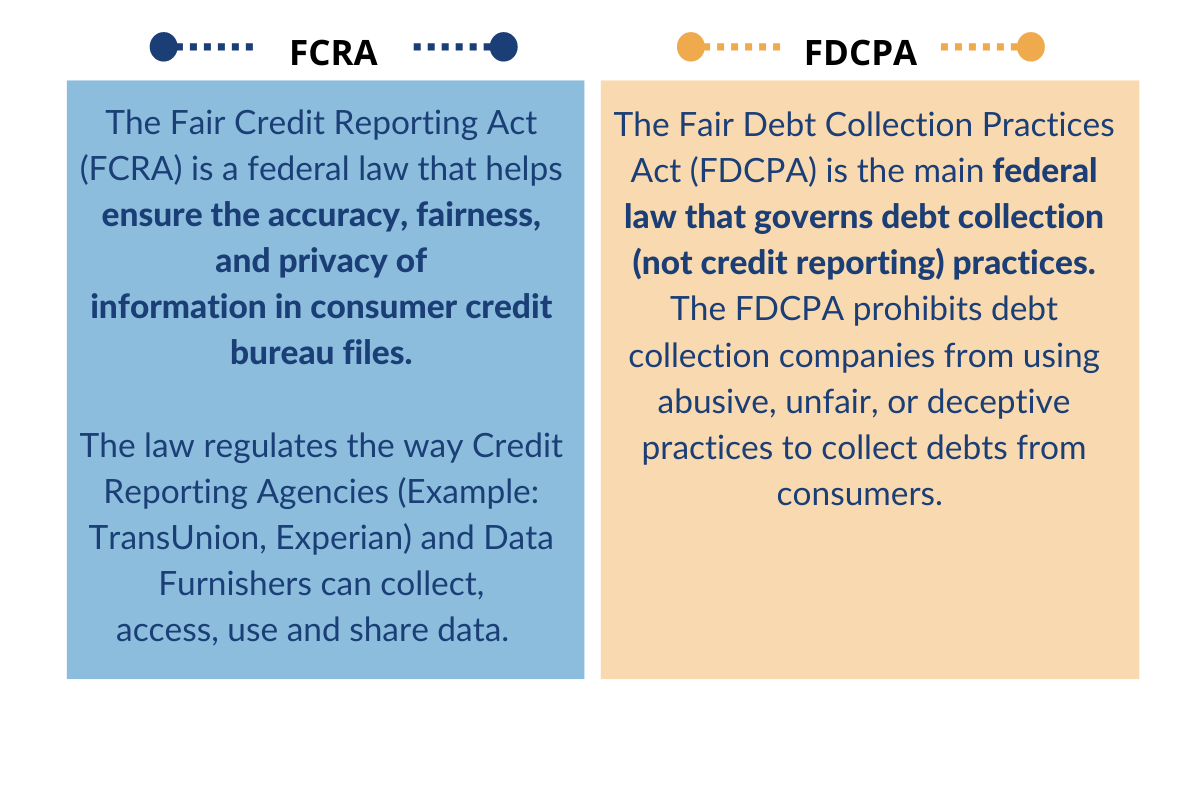

Which regulation governs credit reporting?

The Fair Credit Reporting Act (FCRA) and the Fair Debt Collections Practices Act (FDCPA) are two separate pieces of legislation that govern different industries and business practices. Only the Fair Credit Reporting Act (FCRA) specifically governs credit reporting.

Is it legal to report HOA assessments delinquencies to the credit bureaus legal?

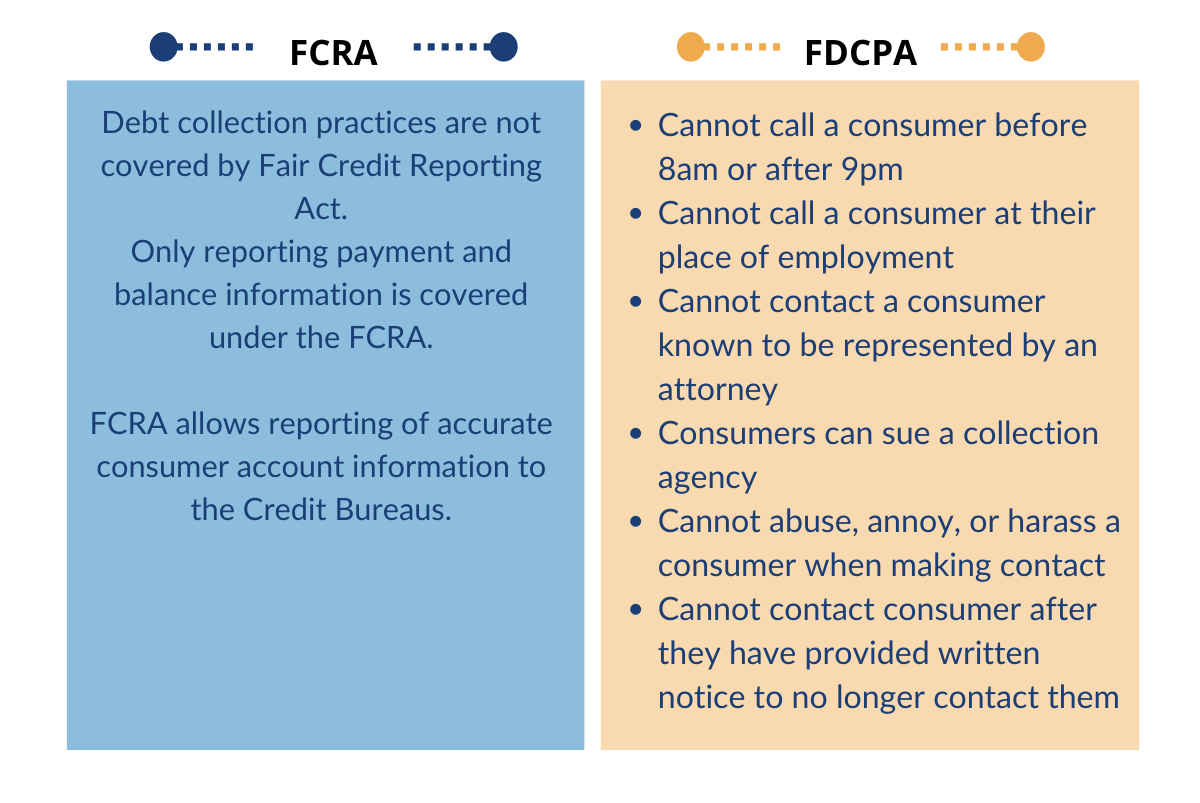

What are the fair debt collections practices?

“Information reported to credit bureaus is subject to the Fair Credit Reporting Act (FCRA). The law requires that furnishers of information to credit bureaus not report information if they know it is inaccurate or have a good reason to believe it is inaccurate. But, if there are mistakes in the information they report, there is no private cause of action under FCRA. There is an exemption in FCRA from furnisher liability to consumers if the information is inaccurate. If there are systemic problems that cause the errors, the regulators can investigate, but as part of its service, Sperlonga assists in avoiding systemic problems.

Under FCRA, furnisher liability to consumers can only arise if consumer disputes are not properly investigated after the consumer disputes information to the CRA.

Sperlonga also manages the consumer dispute process thereby minimizing the risk to the furnishing HOA or management company. Sperlonga’s experience is that the number of consumer disputes is comparatively small. And, in any event, Sperlonga indemnifies the HOAs and management company from any risk in the event they are sued. ” According to Oscar Marquis, from Law Offices of Oscar Marquis & Associates.Mr. Marquis was General Counsel for TransUnion for over 24 years and has served on the Federal Reserve Board’s Consumer Advisory Council.

Read more about Oscar Marquis’ memorandum here.

If you have more questions on reporting assessments to the credit bureaus, reach out to our credit reporting experts at [email protected] or call 818-200-0530.