Do you know why credit score matters? Are your tenants and homeowners aware that their credit scores could affect the interest rates for loans?

Here’s one reason why credit score matters. Your credit score is used by creditors like banks, collection agencies, mortgage lenders, and insurance companies, in making financial decisions involving consumers’ credit-worthiness and solvency.

There could be several factors, but when someone incurs debt, your credit score is usually among the key factors used in determining how much interest rate you will be charged. Usually, the higher the score, the lower the interest rate – which means the less it will cost to borrow money.

But how much difference can a few points in your credit score really make?

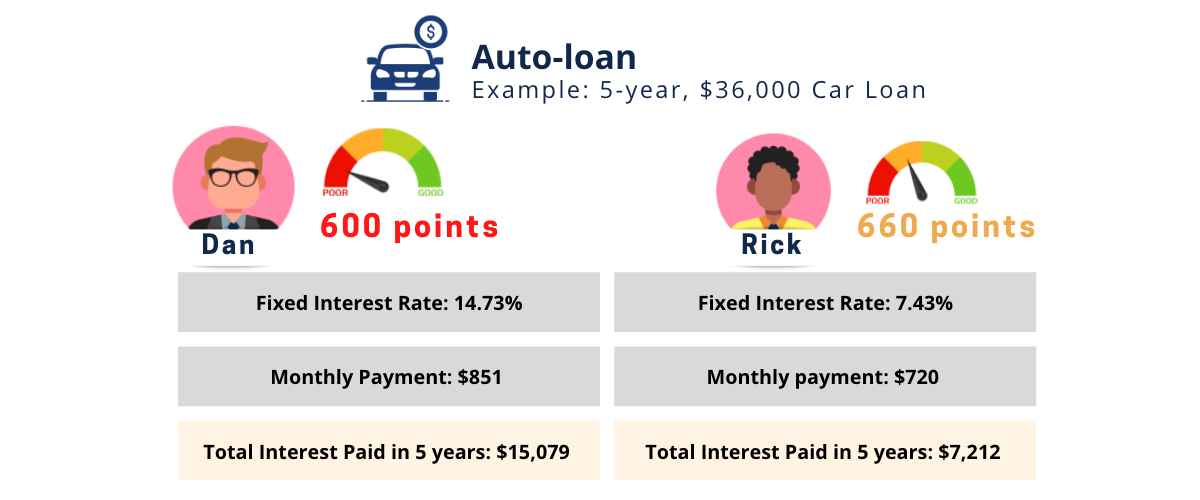

Let’s take getting a loan for a new car in this example from American Express’ blog article.

According to FICO data as of September 2021, if your FICO credit score is at least 720, you may qualify for a 3.828% interest rate on a 60-month car loan.1If your FICO credit score is between 660 and 689, you may qualify for an interest rate around 7.432%. if your credit score is between 590 to 612, you may quality for an interest rate around 14.73%.

How much interest as we talking about here?

With a $36,000 base loan amount for a new car, FICO calculates the total interest owed at $15,079 for the 14.73% interest rate and just over $7,200 for the 7.432% interest rate. (American Express Blog)

That’s around $8,000 difference over the five years, with the higher interest rate translating to an extra $131 per monthly payment.

According to the American Express blog article, the long term cost could even be more. If you invest $60/ month in a ROTH IRA, then let you money grow for another 30 years, you would have more than $17,500 assuming a conservative 5% annualized rate of return. (American Express Blog)

Conclusion:

Now that we’ve put context on how much your credit score can affect interest rate, what could you do to increase or establish your credit score?

There are several strategies to do that, but you could start with reporting rent or HOA assessment payments you are already making. Imagine, according to a Goldman Sachs Study, just reporting your rent could give you 42 points average boost in your score. * You don’t even have to incur additional debt for that boost!

Learn more: Reach out to your property manager or landlord. Schedule a free consultation here.