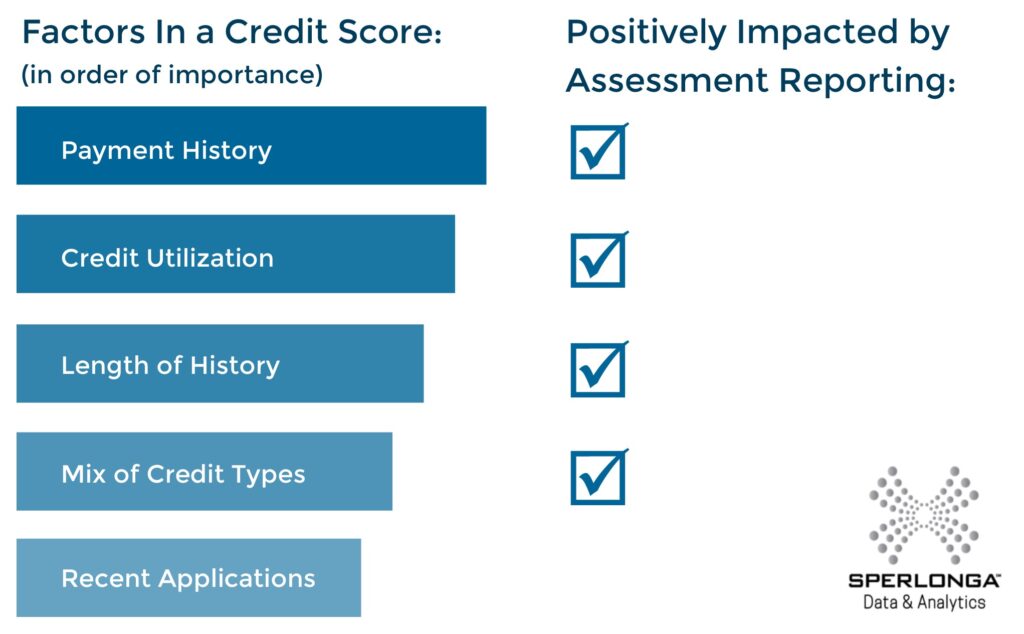

4 of the 5 factors that make up your credit score are positively impacted by reporting your community assessment payments to the credit bureaus. If you make your assessment payments on time, you show that the largest factor in your credit score, your payment history, is positive with yet another financial commitment. By adding your payment history to your credit report, you increase your total credit limit, factor two, which reduces your overall debt to credit ratio. If you have been a member of a community for many years, the third factor also gets a boost. The length of time of your financial commitment also improves your credit score. Finally, your assessment payment history is not a revolving charge card type of credit, so the fourth factor is improved by adding an alternative credit type to your credit profile. You should get the score boost you deserve for your on-time assessment payments. Ask your HOA or management company about credit reporting with Sperlonga today.