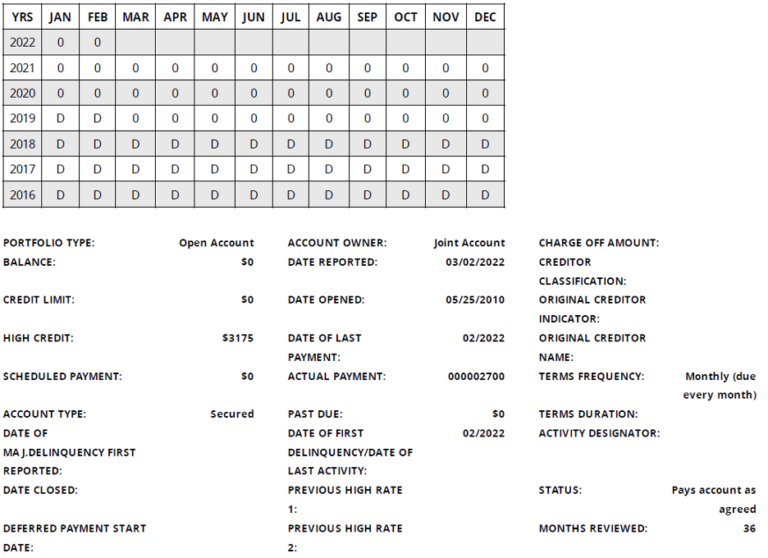

HOA accounts are reported as Open, Secured monthly obligations, which accurately describe the financial relationship between the homeowner and their HOA. As long as they own a home in the HOA, they have a regular, open account with financial obligation. Sperlonga reports many data points related to each account, in addition to the account and portfolio type, including date opened, balance, payment history and past due amounts, if applicable.

The credit bureaus have 5 available Portfolio Type codes under which accounts are reported as follows:

C = Line of Credit

I = Installment

M = Mortgage

O = Open

R = Revolving

“Open” is the best match for HOA accounts since the obligation is ongoing, with an unknown end date, as long as the account holder owns the home.

Sperlonga does not attach the term “loan” to the account in our reporting. This is a function of how either the credit bureau or the credit monitoring service displays the account. Monitoring services such as Credit Karma do not have category for HOA accounts. As a result, they will categorize the account under “Other Loans” since it is the closest match of their available categories (listed below).

- Credit Cards

- Collections

- Student Loans

- Other Loans

- Auto Loans

- Home Loans

From this reporting example, you will see that Sperlonga does not submit “loan” information, we submit account information. The example account is listed as an “Open Account” which is “Secured”.

Credit reporting HOA obligations is new to some areas of the country and can be met with confusion. Overtime, this reporting will become more standard, and the monitoring services will adapt to more accurately display the information.

If you have any questions regarding your specific account, please contact our Consumer Relations department at https://sperlongadata.com/submit-a-dispute/