Credit scores can be confusing, especially for those new to the credit world. Today there are more tools than ever for keeping track of, or helping to improve, credit scores. Websites like Credit Karma offer simulations for how credit changes could impact a credit score. What surprises some is that having more accounts can actually improve a credit score. Why is that?

In the credit world, accounts are viewed as either “thick” or “thin”. Thin accounts tend to be those with 3 or fewer credit lines. Depending on the lender, thin accounts may not qualify for a loan because the lender can’t see enough payment history to meet their credit worthiness requirements. Often renters have thin credit files.

Rental credit reporting helps renters in a couple of ways.

First, credit reporting rental payments adds another account to the credit file which might take that file from thin to thick.

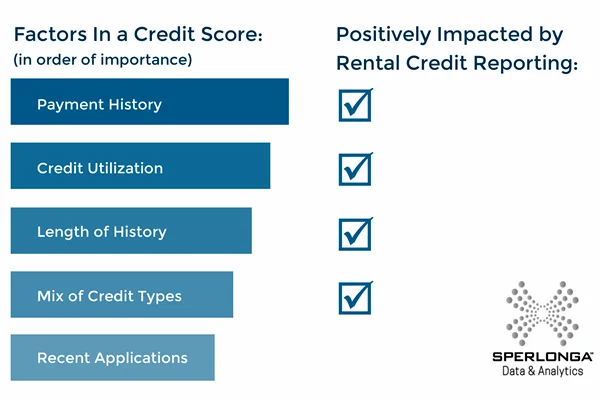

Second, rental credit reporting a positive payment history can really boost a credit score. Scores are made up of 5 primary factors: payment history, credit utilization, length of history, mix of credit types and recent applications. Reporting rental payments benefits the top 4 factors of a credit score. It shows a positive payment history, staying within your total lease agreement amount, more time having an account, as well as having an additional account in your credit file.

Rental credit reporting has to be done by a property management company or landlord. Tenants can’t self report their good rental history. Thankfully, Sperlonga makes rental credit reporting easy. Property management companies simply turn on their connection to Sperlonga in their management software and then credit reporting can start. So if your property management company or landlord isn’t currently reporting your positive rental payment history, ask them to connect with Sperlonga so you can get the boost to your credit score that you deserve.