RENTAL PROPERTY PAYMENT CREDIT REPORTING

RENTAL PAYMENT REPORTING TO THE CREDIT BUREAUS

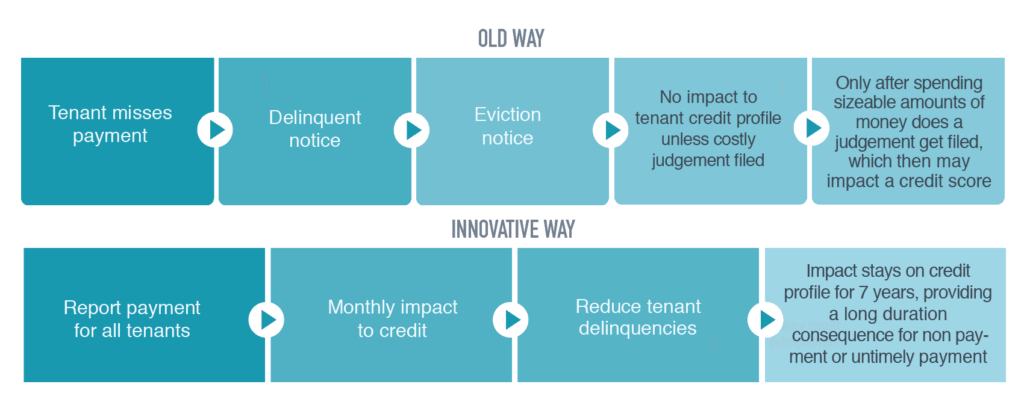

Reporting rental property payments to Credit Bureaus benefits tenant and apartment owners:

- Owners have more leverage to prevent tenant delinquencies

- Helps tenants build credit and improve credit scores

- Helps tenants reduce their finance cost for loans, credit cards, and furniture rentals

- Access to an industry-standard financial and payment management tool

THE SPERLONGA SOLUTION

Sperlonga offers a proactive solution that can help improve the financial health of homeowner associations, rental property owners, timeshares, and self-storage businesses. As a full service data aggregator, our service reduces delinquencies, improves cash flow, positively impacts credit scores, disincentivizes late payments and equalizes the importance of alternative credit and debt payments.

Sperlonga’s mission is to aggregate and build the largest and most dynamic non-traditional assessment payment reporting solution. Our goal is to stay consumer focused and contribute toward rewarding consumers who pay their debt obligations on time with positive impacts to their credit scores and disincentivize consumers from making late payments.

A streamlined approach to improving cash flow and leveraging the reporting of non-traditional payment data

HOW DO PAYMENTS GET REPORTED and WHAT DOES A NON-TRADITIONAL CREDIT OR DEBT ACCOUNT LOOK LIKE ON A CREDIT REPORT?

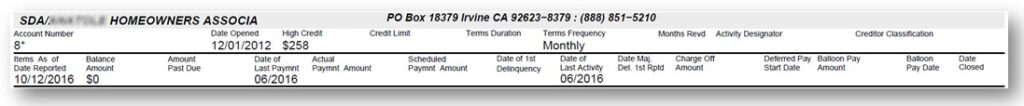

A sample of a how a non-traditional account will appear on a credit report:

Each reported account will list both the “Balance Amount” and the “Amount Past Due”.

The “Balance Amount” is the total amount of reportable transactions, such as assessments, rent, late fees and interest on unpaid balances. The “Amount Past Due” is the portion of the “Balance Amount” that is past due as of the time of the report. The following image illustrates this scenario for payments due within 30 days.

A WIN-WIN FOR NON-TRADITIONAL CREDITORS AND THEIR CUSTOMERS

Benefits for rental property owners and tenant managers:

- Reduce delinquencies

- Increase the value of your portfolio

- Less expensive process to penalize tenants that don’t pay

Benefits for tenants:

- Higher credit scores for those who pay timely

- Build credit faster

- Lower your interest rate for future loans and credit cards with higher FICO scores

- Start getting credit for payments that you have been making for years

- Reduce the likelihood of increases to your payments on non-traditional debt because more consumers pay on time